ARTICLE:

Growing My Business – Money Talks

Secure a loan without putting your home or business on the line…

Getting an unsecured loan is not impossible. Many small business owners still perceive loans as being a bit of a dark art – believing that they need to put their assets or property on the line to get any financial assistance. Thanks to online lending, this isn’t quite the case anymore. Here’s what you need to know to get up to speed with today’s borrowing requirements.

What is an unsecured loan?

An unsecured loan is when the health of a business is used to determine creditworthiness, without the business owner needing to secure the loan by putting up an asset as security. Larger banks tend not to offer these as the arduous paperwork, low returns and higher risks involved don’t make it worthwhile. Many small business owners find themselves having to use an asset to secure a loan, or being declined.

What is asset-based borrowing?

Asset-based borrowing is when a business owner borrows against the value of an asset they own to secure a loan. In essence it’s a way of securing new financing by using the value of what you already have. The asset is usually a personal asset like the family home or a commercial property, or a business asset like a truck or piece of equipment. The vast majority of lenders, especially the big banks, tend to secure loans against an asset. If you have trouble paying back the loan then your asset may be sold by the lender.

How did online lending change the market?

Franchise Central is proud to be part of a big shift in business lending. As a whole, the online lending industry has turned the process of borrowing on its head by making opportunities available to small business owners in need of funding to grow. Speed, Flexibility & Personal Service is the key differences between a big bank and an agile online business lender like Franchise Central.

Why is this good for a small business owner?

1. An online business loan is typically available much faster.

The entire application process can take place online, from start to finish, and takes less than ten minutes. Due to the smart lending platform we use at Franchise Central – we offer fast response times

We can often provide a decision within one hour, if the client has chosen to use our advanced bank verification system to instantly verify bank information online.

2. The amount you can borrow is not dependent on the value of an asset.

If you are going down the path of a secured loan, you can typically borrow a set percent of the value of the asset. However, if your business has a healthy turnover you may qualify for a higher loan amount using an unsecured loan. Franchise Central offers unsecured loans from $5,000 to $500,000 and measures the health of the business to determine creditworthiness.

3. You can build a good credit record with timely payments

If your payment history is exemplary and your lender reports it to the relevant credit bureaus, then your timely payments can help build a better credit profile.

A Success Story…

“We went down this path when we were expanding the business via franchising. Some of the traditional finance options weren’t available to us. Not having many assets and a couple of young directors, the big banks were not very favourable whereas Franchise Central were very easy to deal with and helped us grow.

“Definitely some of the features which suit our business model are the smaller daily repayments. Instead of getting a big bill shock at the end of the month – or even fortnightly – having the weekly repayments come out, you don’t even notice it. A small proportion of the daily takings go to the lender and you don’t even feel it come out of your bank account,” says Franchisor David.

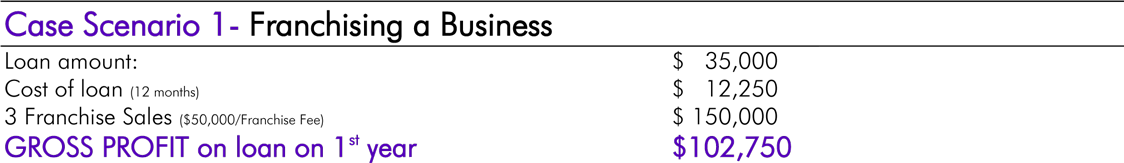

By not using any of the clients own funds, they were able to access $35,000 Unsecured funds to franchise their business; and, at the end of the 1st year with 3 franchise sales was able to earn a gross return of $102,750. The benefit in money terms way exceeded the cost of $12,250 to earn $102,750. The client repays the loan and the cost of the loan in the 1st year and keeps a substantial profit also having established its franchise system bringing with it many other benefits including royalties, buying power, marketing, brand value and more!

With a proven track record of success over the past 25 years, Franchise Central aims to provide solutions tailored to the specific needs of a business/franchise – we understand speed is vital when it comes to small business cash flow and we aim to move as fast as our customers do by looking at their business, not their assets.

GET A QUOTE HERE

to find out if we are the right option for you!

If you have questions, Franchise Central has answers!

CLICK HERE to contact Franchise Central or call us on 1300 558 278.

CONNECT WITH US

LinkedIn | Facebook | Twitter | Get Finance | Subscribe to News