Is an UNSECURED LOAN worth it?***

If getting a loan from your traditional lending channels in not an option for you, then a Franchise Central finance product maybe the way for you to go!

Nick James from Franchise Central (Finance) says unsecured lending is more expensive than secured lending for obvious reasons.

“At the end of the day the benefit of the loan must outweigh the cost of the loan otherwise it won’t make sense.

“You must be clear and ask yourself; ‘What will the benefit derived be worth to you in the short or medium term?’

“To see if the unsecured loan is right for you, try and put a money value on the benefit you will derive from the loan. In other words, how much money will the loan make for you over the next few months or year? You will then be in a position to see if the unsecured loan is worth it.

“With Franchise Central finance products, each loan and rate is tailored to your specific situation – try us and let’s see if we can help you achieve your financial goals”, says Nick James.

Are you looking for finance to help in the setup, management and/or expansion of a new or existing franchise/business?

Franchise Central may be able to help you move forward whether you want to:

- Buy a franchise/business

- Franchise your business

- Open a new or additional site/store

- Purchase new and/or additional stock

- Renovate and/or update your business fitout

- Purchase additional/new plant & equipment

- Employ and/or train more staff

- Marketing and advertising

- Increase your working capital

- Start new contracts or jobs

- Pay GST &/or TAX bills

- Operational expenses

- Settle an unforeseen contingency

- Get FINANCE for ANY other PURPOSE

Recent scenarios where Franchise Central was able to provide the best solution…

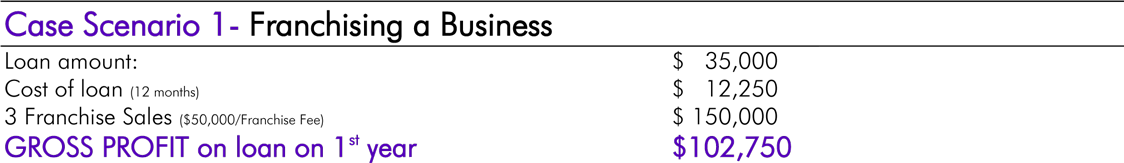

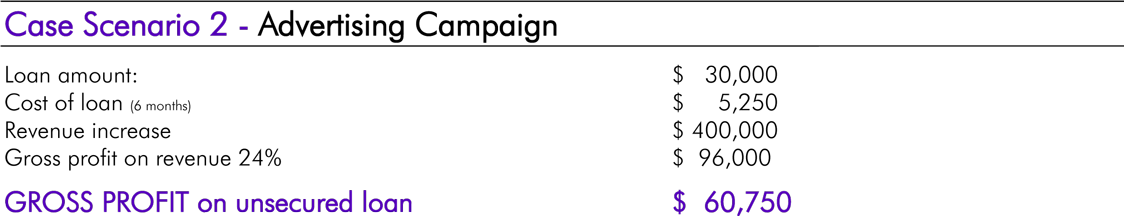

Here are some examples where we have been able to assist clients recently with unsecured loans and their gross profits after repaying the loan and cost of the loan:

By not using any of the clients own funds, they were able to access $35,000 Unsecured funds to franchise their business; and, at the end of the 1st year with 3 franchise sales was able to earn a gross return of $102,750. The benefit in money terms way exceeded the cost of $12,250 to earn $102,750. The client repays the loan and the cost of the loan in the 1st year and keeps a substantial profit also having established its franchise system bringing with it many other benefits including royalties, buying power, marketing, brand value and more!

Client was able to take advantage of increased sales volume generated by a radio advertising campaign that returned a gross profit to the client of $60,750 after repaying the loan and the cost of the loan in 6 months.

The client discovered its wholesale supplier needed to offload a line of products and was discounting the stock. We were able to assist our client within 48hrs to have access to the required funds to buy all the stock at a substantial savings and sell it over the following months. This was a twofold financial benefit for our client. Firstly, the savings on the actual cost of the stock by being able to buy the lot at a reduced cost; and, secondly, the gross profit on selling the stock over the coming quarter as per normal trading. All done for a net return of $32,065 in 3 months after repaying the loan and cost of the loan – nice!

The client was able to buy out a competitor in a shopping centre that the client wanted a franchise site in. He invested some of the money to clean up and convert the existing business, got their brand in the shopping centre, site is earning $$$ from day one and then sell as a going concern at a profit that will continue to earn royalties. A win-win for everyone!